- placemakingpodcast@gmail.com

Creating a Lasting Legacy Through Investing in Small Change with Eve Picker – Ep. 40

About the Guest

Hello and welcome to Episode #40 of the Placemaking Podcast!

Another great episode is coming your way. I am thrilled to share this next conversation with all of you. Eve is the Founder of Small Change. Her background as an architect, city planner, urban designer, real estate developer, community development strategist, publisher, and instigator give her a rich understanding of how cities work, how urban neighborhoods can be revitalized, what policies are needed to do it, and the unique marketing that creates the buzz needed for regeneration. Needless to say, she knows her stuff when it comes to the business of real estate.

As mentioned above, she founded Small Change, a real estate equity crowdfunding platform. Their goal is to raise funds for meaningful real estate projects building better cities everywhere. Like Kickstarter for real estate—but with a return. They match developers to investors, providing investment opportunities for everyone who cares about cities and wants to make change. All through a fluid and compliant technology platform. It’s really a unique and interesting platform. The platform allows allows for everyone to invest in small change throughout their community.

In this episode, we are going to discuss the genesis of Small Change, the difficulties that Eve and her team faced when starting up this platform, as well as understanding the process for offering and investing on projects within the platform. There is loads of great information in this episode and I greatly appreciated Eve for taking the time out of her busy schedule to discuss this topic of real estate development crowdfunding with me.

Main Take-Away’s From This Show

This was another fun episode to record. Eve has a seemingly traditional route into real estate development, but along her journey, has taken on careers and projects that have helped to shape her into the agent of change that she now is. Her main vehicle for change now is the crowdfunding platform she founded that allows developers the opportunity to obtain capital from those that might not have been able to provide it in the past. There were several great talking points that Eve shared throughout the discussion, so it is hard to just pick three for my main take-away’s this week. The following main topics of the show come from a deep understanding in the real estate development process that Eve possesses.

- The Jumpstart Our Business Startups (JOBS) Act really helped to set the stage for crowdfunding startups.

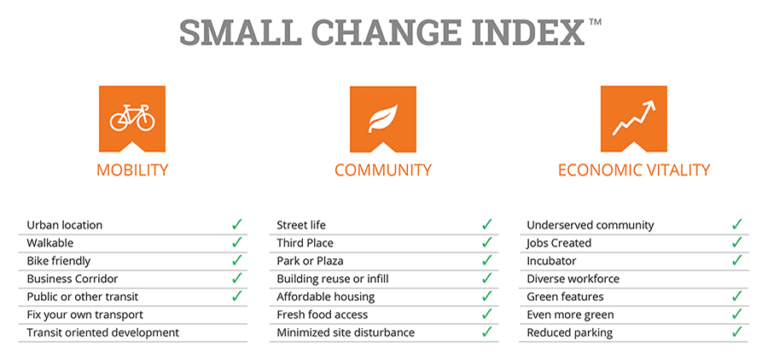

- Small Change utilizes an index, called the Small Change Index, to judge a projects potential to provide lasting benefits to their surrounding community.

- Access to capital can often be the barrier to entry for developers looking to make an incremental increase to their surrounding communities; Small Change helps to combat this.

As always, I will dig into each of these “take-away’s” every week on the blog. So, without further a due, here we go!

The Jumpstart Our Business Startups (JOBS) Act really helped to set the stage for crowdfunding startups.

Eve pointed out to me this very important piece of legislature that I didn’t really understand initially, but helped to provide an avenue for investment into small businesses everywhere. This was the Jumpstart our Business Startups or JOBS act of 2017. Signed into law by President Barack Obama on April 5, 2012, “Title III, also known as the CROWDFUND Act, has drawn the most public attention because it creates a way for companies to use crowdfunding to issue securities, something that was not previously permitted.” (Wikipedia Article)

As mentioned, this act allowed individuals that weren’t considered “High Net Worth Individuals” by the IRS to invest in securities of companies that met the requirements provided by the SEC.

Just as a reminder for those that don’t normally reside in the capital markets, “The term “security” refers to a fungible, negotiable financial instrument that holds some type of monetary value. It represents an ownership position in a publicly-traded corporation via stock; a creditor relationship with a governmental body or a corporation represented by owning that entity’s bond; or rights to ownership as represented by an option.” (Investopedia Article) Essentially you are purchasing either debt or equity in a company.

Now that we know a little about the legislature behind the act, we can begin to see how this could be applied to real estate development as well. This opened up a world for those that might not normally be able to obtain capital as well as be able to invest in this type of security as well. This allowed Eve and her team to build the architecture surrounding Small Change.

Small Change utilizes an index, called the Small Change Index, to judge a projects potential to provide lasting benefits to their surrounding community.

This next main point is one that makes Small Change so unique and different. They have pulled together a proprietary “Small Change Index” from which to judge potential projects. This index gives them the ability to review a project more objectively and quantitatively to see if it fits the values of the Small Change platform.

The Small Change Index is comprised of three (3) main categories with smaller sub-categories underneath each. The three overall categories are; Mobility, Community, and Economic Vitality. Some of the sub-categories underneath these titles are; Urban Location, Walkability, Building Reuse or Infill, Affordable Housing, and Incubator to name a few.

According to the Small Change website, “The Change Index uses data points such as an area’s walk – and bike-ability, public transit access, proximity to green space, availability of commercial and cultural amenities and other measures of quality of life to gauge the possibilities of a project. Our Change Index keeps us on the straight and narrow. Offerings on the Small Change platform must score at least 60% to be listed, to ensure that we’re making change right alongside you.”

This Index truly allows Small Change to pursue their mission to “allow everyday people to invest in real estate projects that change cities and neighborhoods for the better.”

Access to capital can often be the barrier to entry for developers looking to make an incremental increase to their surrounding communities; Small Change helps to combat this.

Real estate development is not an equitable endeavor at the moment. It’s not impossible to raise funding for a project if you don’t have experience or a large bank account, but it’s pretty darn hard to. As a woman developing in a fairly conservative City such as Pittsburg, Eve found it extremely difficult to raise capital for her development projects. Her story is not unlike many others that are trying to rebuild their community.

Its much harder for a minority developer to raise the capital needed to really make an impact in the surrounding community. Luckily Small Change is here to highlight this disparity and provide an alternative lending platform that makes real estate development more equitable for those not born into a wealthy family or of a different ethnicity or race.

I’m really excited to see how the projects raising capital on Small Change are going to impact the surrounding communities, as well as inspire other minority developers to make an impact in their community as well. This platform has been a labor of love for Eve and her team and I really think it has the opportunity to create more than just a “Small Change” in communities across North America.

As you can see from the take-aways above, this podcast episode was full of amazing information on making it in real estate development and absolutely provides actionable steps you can take on your next real estate development project. As always, if you have enjoyed the content and the show, please subscribe to the show below and share with your friends! We’ll have many more great discussions on the shows to come.

To Learn More About Eve Picker and Small Change, Check out the Following Websites:

Recommended Reading Section

For more on alternative financing for your next Real Estate Development Deal, check out Exploring Alternative Lending on Your Next Real Estate Development Project with Antoin Watson (Ep. 25) to give you a perspective on possible alternatives to bank financing on your next deal.

P.S. We spend (a lot) of time, sweat, tears, and money creating each episode of The Placemaking Podcast. We do this without the support of sponsors as we want to keep the advertisements out of the picture and provide an add-free listening experience. YOUR support ensures we can keep delivering these discussions ad-free!

If you feel compelled to donate to the show (and receive some cool bonuses…) you can check out my Patron Page.

Podcast: Play in new window | Download (Duration: 50:41 — 29.8MB) | Embed

Subscribe: Apple Podcasts | Spotify | TuneIn | RSS | More